In the ever-evolving world of cryptocurrencies, the journey from setting up a mining rig to generating substantial revenue can feel like navigating a labyrinth of innovation and volatility. Dogecoin, the meme-inspired cryptocurrency that started as a joke but has surged into serious contention, exemplifies this dynamic landscape. With its origins tied to the playful Shiba Inu dog meme, Dogecoin has captivated investors and miners alike, boasting lightning-fast transactions and a vibrant community. Yet, as enthusiasts dive into mining this digital asset, the costs associated with hosting mining machines emerge as a critical factor. This expert analysis delves into Dogecoin mining hosting prices, exploring how they stack up against the broader ecosystem of Bitcoin, Ethereum, and other altcoins, while uncovering strategies to maximize returns in an unpredictable market.

At the heart of Dogecoin mining lies the essential mining rig, a sophisticated assembly of hardware designed to solve complex cryptographic puzzles and validate transactions on the blockchain. These rigs, often comprising powerful GPUs or ASICs, demand significant electricity and cooling resources, making hosting services an attractive option for many. Hosting providers offer data centers equipped with state-of-the-art facilities, where miners can rent space for their equipment, thereby sidestepping the hassles of home setup. For Dogecoin specifically, hosting prices fluctuate based on factors like location, energy costs, and network difficulty. As of recent trends, hosting a Dogecoin rig might cost anywhere from $50 to $200 per month per terahash, depending on the provider’s efficiency and the region’s regulatory environment. This variability introduces an element of burstiness into the mining world, where sudden price spikes or dips can dramatically alter profitability.

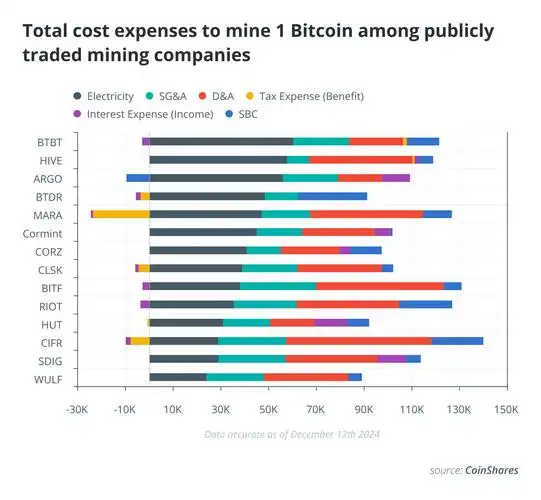

Transitioning to broader comparisons, Bitcoin’s dominance in the crypto sphere means its mining hosting prices often set the benchmark. Unlike Dogecoin, which benefits from a less competitive network, Bitcoin requires immense computational power, pushing hosting fees upward to around $100 to $300 per terahash monthly. Ethereum, with its shift toward proof-of-stake via the Ethereum 2.0 upgrade, presents a contrasting narrative; miners are adapting rigs for other purposes, and hosting costs for ETH mining have dipped to $80-$250 per terahash as the ecosystem evolves. These differences highlight the unpredictable nature of the market, where Dogecoin’s accessibility contrasts sharply with the high-stakes world of BTC and ETH. Miners must weigh these options carefully, considering not just price but also the potential for revenue bursts driven by market sentiment or technological advancements.

Delving deeper, mining farms—vast warehouses filled with rows of humming rigs—play a pivotal role in scaling operations for currencies like Dogecoin. These farms optimize energy use and maintenance, often reducing individual hosting costs through economies of scale. For instance, a mid-sized farm might host Dogecoin miners at rates as low as $0.05 per kilowatt-hour, compared to higher fees for BTC setups that demand more robust infrastructure. This setup not only lowers barriers for newcomers but also injects diversity into the mining community, blending hobbyists with professional operators. Yet, the rhythm of this industry pulses with irregularity; a sudden Dogecoin price rally could amplify revenues overnight, turning modest investments into lucrative ventures, while regulatory shifts might introduce unforeseen expenses.

In contrast, the individual miner’s experience often revolves around personal mining rigs, which can be more cost-effective for small-scale operations. A typical Dogecoin rig, equipped with efficient hardware, might yield returns that outpace initial hosting fees during bullish periods. However, as Ethereum’s network evolves, miners are repurposing rigs for Dogecoin or other altcoins, creating a fluid interchange that enriches the ecosystem. This adaptability underscores the infectious energy of crypto mining, where strategic decisions about hosting can mean the difference between profit and loss. Exchanges like Binance or Coinbase further complicate the picture, offering tools for selling mined coins that influence overall revenue strategies.

Ultimately, the path from rig to revenue in Dogecoin mining hosting demands a keen eye on market trends and technological shifts. As Bitcoin and Ethereum continue to influence global standards, Dogecoin’s lighter requirements make it an appealing entry point for enthusiasts. By leveraging diverse hosting options and staying attuned to price fluctuations, miners can craft a more layered and attractive portfolio. The future holds promise for innovation, perhaps with greener energy solutions or advanced rigs that enhance efficiency. In this vibrant arena, the key lies in embracing the burstiness and diversity of the crypto world, transforming potential challenges into opportunities for substantial financial gains.

Leave a Reply